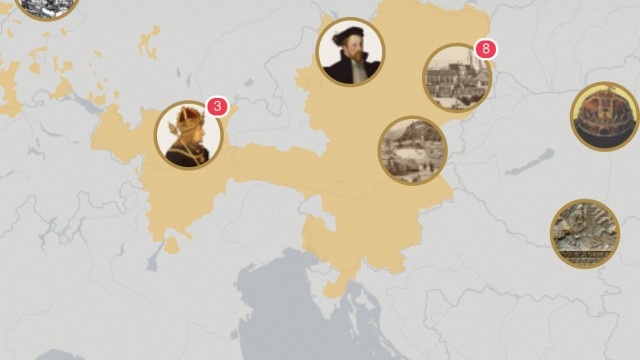

Money of paper – Financial necessity is the mother of invention

Today it is taken for granted that payments can be made both with coins and with paper money – and even with ‘plastic money’ in the shape of credit cards. In the eighteenth century paper money was something completely new.

In the eighteenth century people mostly had coins in their purses and made payments in gold ducats and silver thalers. Hence it must have been something of a sensation when it was announced that henceforth money made of paper would be the means of payment. This was a result of the serious financial problems caused by the Seven Years’ War (1756–63). This cost some 250,000,000 gulden and thus swallowed up around three-quarters of the gross domestic product. In order to finance the war a ‘war tax’ was levied in Vienna. Apart from that, the major source of finance for the war took the form of loans, which meant that the interest payments on them used up approximately one-fifth of the state’s revenue.

In order not to make money even scarcer and to avoid deterioration of the coinage – in times of economic difficult the fineness of coins was reduced – Maria Theresa ordered banknotes (Bancozettel) to be issued. This did in fact lead to people making a significant proportion of their payments in paper money. Finally even fifty per cent of some tax payments had to be settled in paper money.

However, the wars fought in the late eighteenth century – the campaign against the Turks in 1788 and the wars against revolutionary France from 1792 – once again brought the Monarchy into severe financial difficulties, so that Franz II (I) drastically increased the amount of paper money in circulation; then the cost of war reparations to France after the Peace of Schönbrunn in 1809 drove up inflation, and by 1811 the state was bankrupt. The response to this was to exchange the banknotes for ‘redemption notes’ (Einlösescheine) – also known as ‘Vienna currency’ (Wiener Währung) – and to found the national bank.